Tax Preparer Letter To Client

Not yet a subscriber. A copy of your current Certificate of Registration a current price list itemizing all your services and.

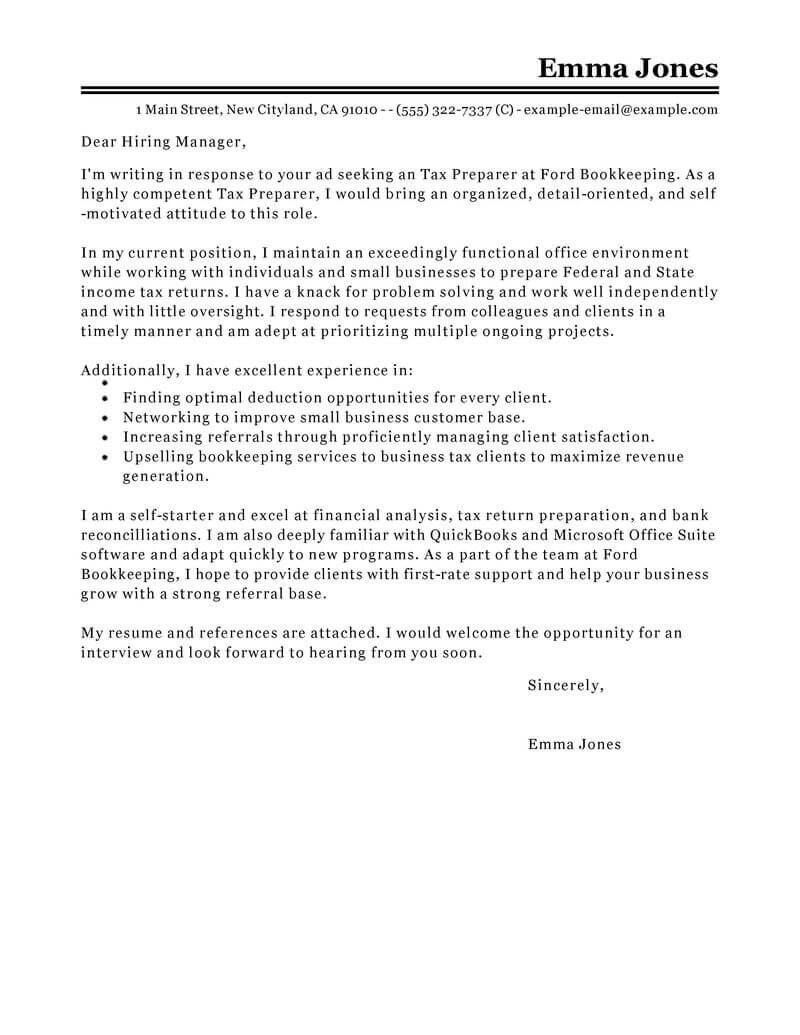

Income Tax Preparer Cover Letter Example Kickresume

The companys clients told investigators they had not provided the information that was submitted on their behalf.

. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. May not be combined. With a money-back guarantee Bradford.

Investigators with the Louisiana Department of Revenue LDR say the three women working for Global Tax Service charged clients as much as 110 to prepare and submit the sales tax refund form using false information and inflating the value of the losses. Tax preparers and clients must fill in Form 8948 and submit it along with the other tax returns documents. Are a nonexempt tax preparer who prepares income tax returns that are bundled or included with other services.

A new client is an individual who did not use HR Block office services to prepare his or her 2016 tax return. How you report a tax return preparer for misconduct associated with your individual tax return depends on whether or not you received a notice or letter. Whether it is in an email or a telephone inquiry regarding an issue or request related to my finances my concern is dealt with in timely fashion.

What are the most common tax forms and types of tax returns prepared by a tax preparer. Depending on levels of experience your client roster and the specifics of your business the types of tax returns a preparer will work on can range from an Individual Income Tax Return Form 1040 to a Corporation Income Tax Return Form 1120 to interpreting complex partnership agreements. But the tax crime of aiding another to prepare a false document captures more than just CPAs and enrolled agents.

May not be combined. Government Accountability Office GAO recommended in a report Thursday and the IRS agreed that the Service should test the feasibility of holding videoconference visits with tax return preparers it flags as posing a high risk for submitting erroneous refundable credit claims to replace in-person visits the Service has suspended since. Because of the quality of this organization at every level I actually feel like I am a team member.

AMG clearly personalizes all of their relationships with. I have been a client of Advisors Management Group for more than a quarter of a century. It includes anyone who prepares false.

Section 7216 makes it a crime for any preparer to knowingly or recklessly disclose any information that is furnished to the preparer in connection with preparing a clients tax return or use tax return information other than to prepare or assist in preparing that return thus establishing a prohibition on disclosure or use of a taxpayers. If you received a notice or letter from the IRS. If you offer transmission services to clients who prepare their own returns we consider you to be acting as the tax preparer and require you to fulfill all the responsibilities outlined below.

Deal directly with your client. Determine your clients eligibility for the credits or HOH filing status or to compute the amount of the credits you must. For example a tax return preparer discloses tax return information when she provides client tax documents to another person in her firm.

It Could Cost You Thousands in Tax Deductions Home. Offer valid for tax preparation fees for new clients only. Are a nonexempt tax preparer.

Youll be able to read the full article and get instant access to the last few issues of the Tax Reduction Letter. Tax Return Preparer PDF. One thinks here of a CPA enrolled agent or other tax preparer who is trying to help his or her client pay less tax but that person the taxpayer himself or herself was not involved in the tax preparation process.

If youre a tax return preparer facilitator or both you have posting requirementsYou must post the following itemsprominently and conspicuously at every location where you provide tax preparation or facilitation services. You cannot accept and transmit records from an unregistered preparer. A new client is an individual who did not use HR Block office services to prepare his or her 2016 tax return.

Offer valid for tax preparation fees for new clients only. Receive a fee for the bundle of services which include the preparation of the income tax return. Are you a tax professional eg tax preparer or tax attorney.

Complete Form 14157-A Tax Return Preparer Fraud or Misconduct Affidavit PDF and Form 14157 Complaint. A client must then sign a document that verifies that it was his choice to file tax returns manually. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

Ask your client additional questions if a reasonable and well-informed tax return preparer knowledgeable in the law would conclude the information furnished seems incorrect inconsistent or incomplete. With a Tax Professional account and your clients authorization you can request an installment payment agreement respond to a bill or notice request penalty abatement for your client apply for an extension of time to file check an estimated tax balance and more. A tax preparer could also waive filing tax returns electronically if there.

Use of tax return information is any circumstance in which a tax return preparer refers to or relies upon tax return information as the basis to take or permit an action Treasury Regulations section 3017216-1b5. Take income tax data from a client and enter it into a computer andor prepare the income tax return. If a client prefers paper filing the tax preparer can do so.

Tax Preparer Cover Letter Examples Finance Livecareer

Tax Preparer Cover Letter Sample Skills Writing Guide

Irs Letters To Tax Preparers On The Rise Pronto Tax School

Tax Preparer Cover Letter Examples Finance Livecareer

Tax Preparer Cover Letter Examples Finance Livecareer

Personal Tax Engagement Letter By True North Accounting Issuu